nj tax sale certificate

If a bid made at the tax sale meets the legal requirements of the Tax Sale Law the municipality must either sell the lien or outbid the bidder. At the sale a lien will be sold for the amount due with interest starting at 18 and going down as bid.

Further additional assignments recorded.

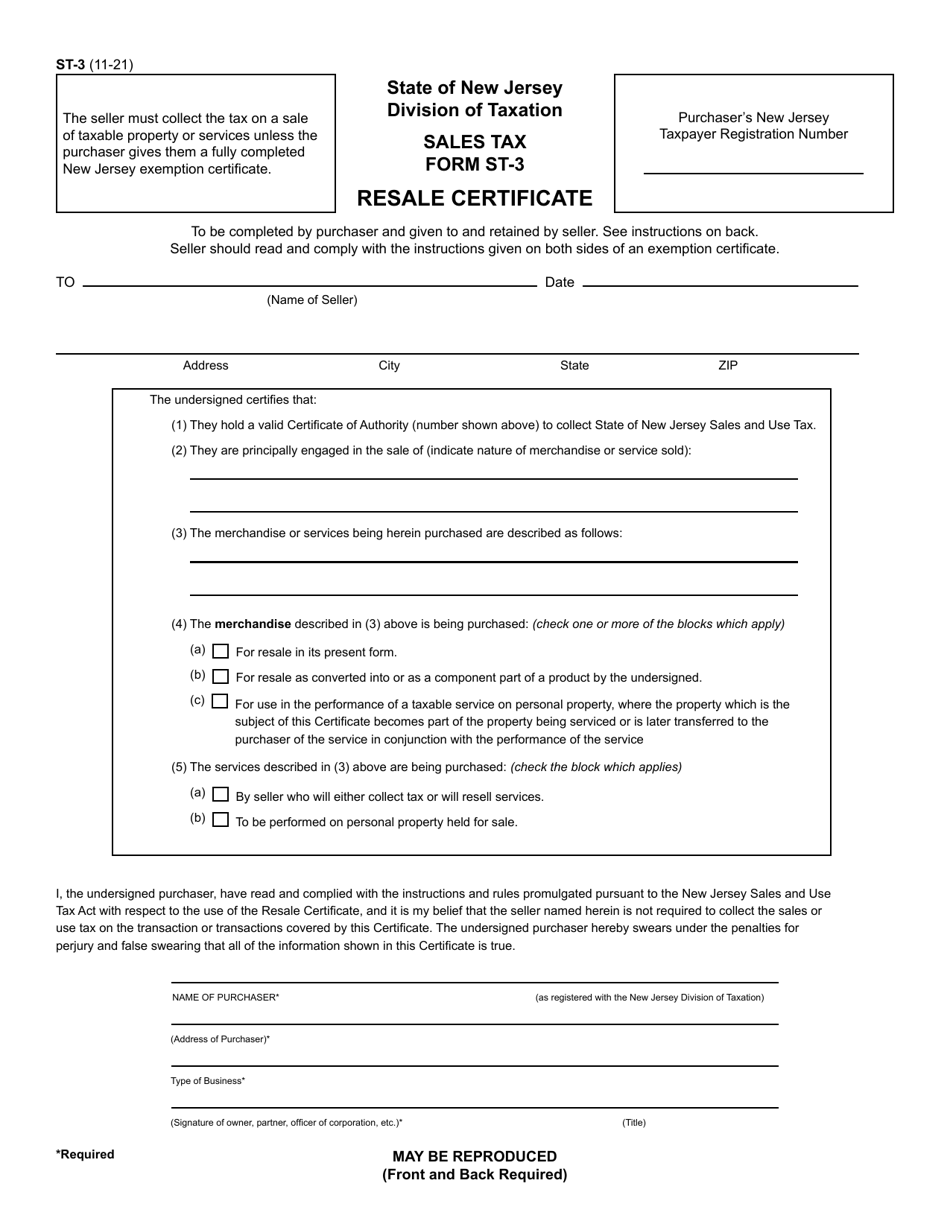

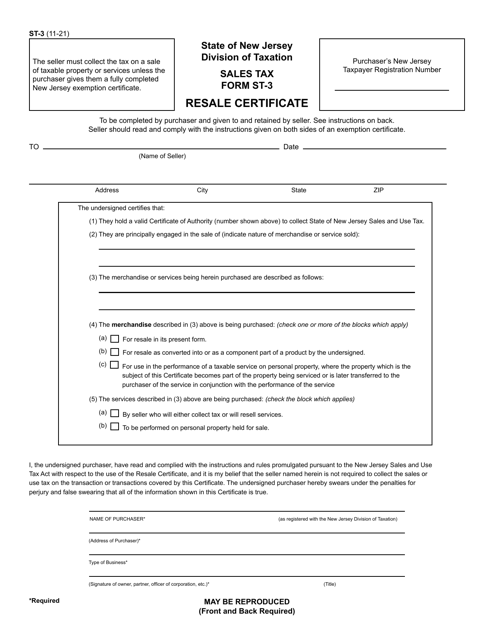

. A New Jersey resale certificate also commonly known as a resale license reseller permit reseller license and tax exemption certificate is a tax-exempt form that permits a business to purchase goods from a supplier that are intended to be resold without the reseller having to pay sales tax on them. The tax sale can be held at any time after April 1st. Name of the tax.

Instantly Find and Download Legal Forms Drafted by Attorneys for Your State. Once registered you must display your Certificate of Authority for Sales Tax Form CA-1 at your business location. New Jersey offers grants incentives and rebates to businesses and every recipient must obtain a business assistance tax clearance certificate from the Division of Taxation.

Instead the winner of the Tax Sale Certificate now has a lien against the property in the amount paid for the Tax Sale Certificate plus interest and penalties which will continue to accrue. A tax sale list will be published weekly in the echoes-sentinel for four weeks. Business Tax Clearance Certification Required for Receiving State Grants Incentives.

36 months from the date of the tax lien sale Create an assignment of the county rights in the tax lien sale certificate. 30 rows Sales and Use Tax. Nj Tax Sale Certificate Redemption Buyers appear at the tax sale and purchase the tax sale certificates by paying the back taxes to the municipality.

New Jersey is a good state for tax lien certificate sales. As a seller of taxable goods or services you are required to be registered with the New Jersey Division of Revenue and Enterprise Services. In New Jersey tax lien certificates are sold at each of the 566 municipal Tax Sales.

The issuance of the tax sale certificate set the amount the property owner could pay to redeem the certificate and under new jersey tax law this redemption amount accrued interest at a rate of 18 percent. The fill in cover sheet form is available at this link. Purchasers of tax sale certificates liens.

Tax delinquent properties are advertised in a local newspaper prior to the municipal tax sale. By posting this notice the State of New Jersey neither recommends nor discourages investment in tax sale certificates and makes no guarantee of profit or positive result from such investment. The holder of a New Jersey Tax Sale Certificate does not own the property.

Tax Sale Certificate Basics All owners of real property are required to pay both property taxes and any other municipal charges. The municipal tax collector conducts the sale which allows third parties and the municipality itself to bid on the tax sale. Tax Sale Certificates are recorded in County Clerks Office.

This is your permit to collect Sales Tax and to use Sales. Every New Jersey municipality is authorized by statute to conduct public tax sales due to the non-payment of real estate taxes by the property owner. Assignment Certificate or Assignment of Rights Form Sign and seal this form.

Sale of certificate of tax sale liens by municipality. Here is a summary of information for tax sales in New Jersey. Buyers appear at the tax sale and purchase the tax sale certificates by paying the back taxes to the municipality.

Tax liens are also referred to as tax sale certificates. Methods of sale of certificate of tax sale by municipality. The delinquencies will be subject to interest and charges as set forth by the state of New Jersey.

A cover sheet or electronic synopsis. New Jersey 08210-5000 Tax Sale Certificate Redemption Purpose The purpose is to discharge an original Tax Sale Certificate. Anyone wishing to bid must register preceeding the tax sale.

Requirements NJSA 4626A NJSA 545 1. Interest rates at the auctions start at 24 and can eventually be bid down to zero. Thus when you pay your taxes.

February 1 May 1 August 1 and November 1. Ad Get Access to the Largest Online Library of Legal Forms for Any State. After July 1 2017 any applicant for certification that cant obtain a Premier Business Services.

18 or more depending on penalties. In New Jersey every municipality is required by law to hold sales of unpaid property taxes at least once each year. A lienholder may begin to foreclose on the property two years after the purchase of the tax sale certificate.

The municipalities sell the tax liens to obtain the tax revenue which they should have been paid by the property owner. Property taxes are payable in four installments. Sales subject to current taxes.

The sale of a tax lien on a property does not give the purchaser of the certificate any rights of ownership or to trespass on the property. In New Jersey property taxes are a continuous lien on the real estate in the full annual amount as of the 1stof the year. Tax sale certificates require active follow up and management by the investor.

It allows suppliers to know that you are legally allowed to purchase the goods without. However if someone would like to purchase them they must contact the Municipal Tax Assessors office in the city of interest. This is acquired by the foreclosure process.

Ad New State Sales Tax Registration. What if I Sell Taxable Goods or Services in New Jersey. The municipality will issue a tax sale certificate to the purchaser who then must pay the real estate taxes for a minimum of 2 consecutive years as a condition precedent to filing suit to foreclose the lien.

The tax lien sale certificate will show the assignee the first date that they would be entitled to a tax deed to the property. Foreclosure right of redemption recording of final judgment. Nj Tax Resale Certificate information registration support.

In any action in the Superior Court to foreclose the right to redeem from the lien of a certificate for the nonpayment of taxes or other municipal lien whether brought under the In Rem Tax Foreclosure Act or otherwise if the. Action to foreclose tax sale certificates. New Jersey Tax Lien Auctions.

Redemption a Severance Upon Answer.

Vintage 1940 Buick Sedan Auto Title Only Historical Document From Michigan Car Title Historical Documents Buick Sedan

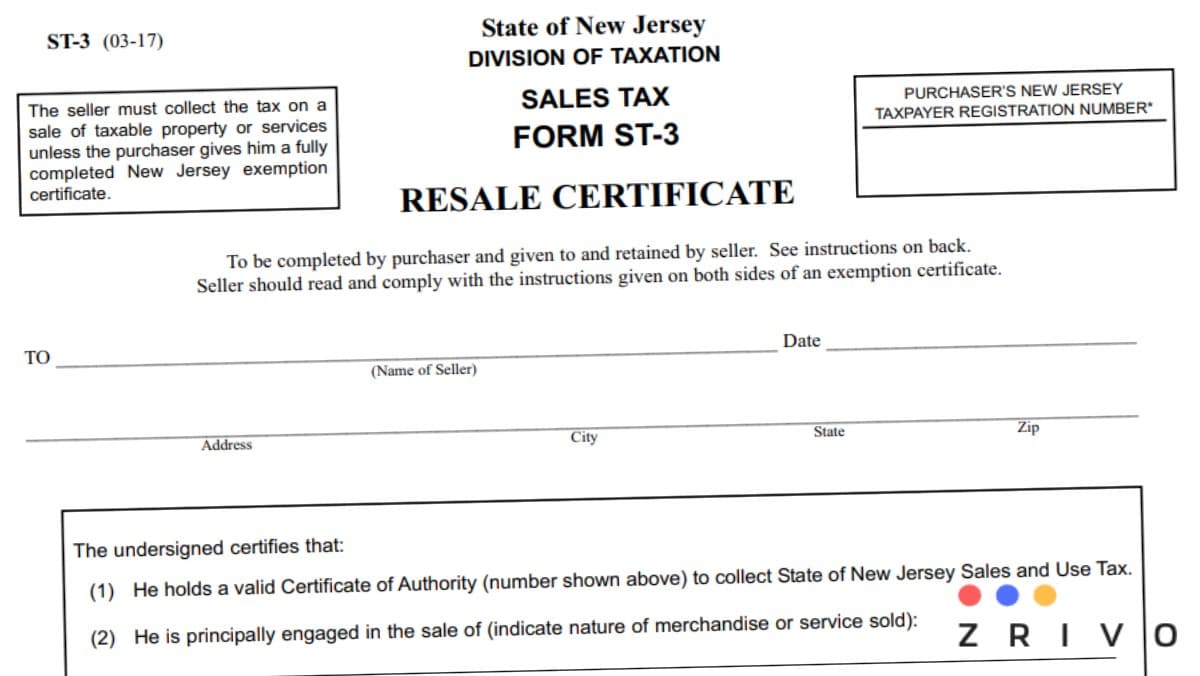

New Jersey Resale Certificate Trivantage

Form St 3 Download Printable Pdf Or Fill Online Resale Certificate New Jersey Templateroller

Explore Our Free Eviction Notice Template Nj Eviction Notice Being A Landlord Templates

Gia Certified Jadeite Jade Diamond White Gold Brooch Gold Brooches Diamond White White Gold Set

St3 Form Nj 2021 Sales Tax Zrivo

Form St 3 Download Printable Pdf Or Fill Online Resale Certificate New Jersey Templateroller

Texas Sales And Use Tax Exemption Certification Blank Form With Regard To Sales Cert Letter Templates Certificate Templates Certificate Of Achievement Template

Another Pic For Valentines Gift Certificates Valentine Massage Valentine Day Massage Massage Gift Certificate

Browse Our Image Of Holding Deposit Form Template Being A Landlord Proposal Letter Receipt Template

St3 Form Nj Fill And Sign Printable Template Online

American Express Stock Certificate Stock Certificates American Express Dow Jones Index

Save Time And Money On Resale Certificate And Oracle Paperwork

Furniture Bill Of Sale How To Create A Furniture Bill Of Sale Download This Furniture Bill Of Sale Bill Of Sale Template Bill Of Sale Car Business Template

Form St 3 Download Printable Pdf Or Fill Online Resale Certificate New Jersey Templateroller